EADSY Stock Forecast & Airbus SE Chart Analysis

This article provides a detailed analysis of EADSY-Airbus SE stock including a forecast for EADSY shares. It features Airbus SE technical analysis, support and resistance levels, financial report evaluations, buy and sell signals based on simple moving averages and MACD, and artificial intelligence-assisted target price predictions

Stocks can be purchased through banks, brokerage firms, investment funds, and individual retirement systems.

EADSY Historical Data Review

EADSY Current Price Performance Analysis

The Airbus SE - EADSY stock traded on the American stock market, on 06-05-2024, closed at 41.7$ with a %0.02 increased compared to the previous day.

In the last month, the price of EADSY changed by %-1.40 decreased in value, from 42.29 dollars on 05-06-2024 to 41.7 dollars, decreased.

Last year, the price of EADSY was 34.28 dollars on 06-06-2023, and changed by %21.65 increased in value, to 41.7 dollars increased within a year.

The price of Airbus SE stock is below both the 50-day and 100-day moving averages. Looks a bit grim for the medium and long term. Investors might want to tread carefully here, maybe give those risk strategies another once-over.

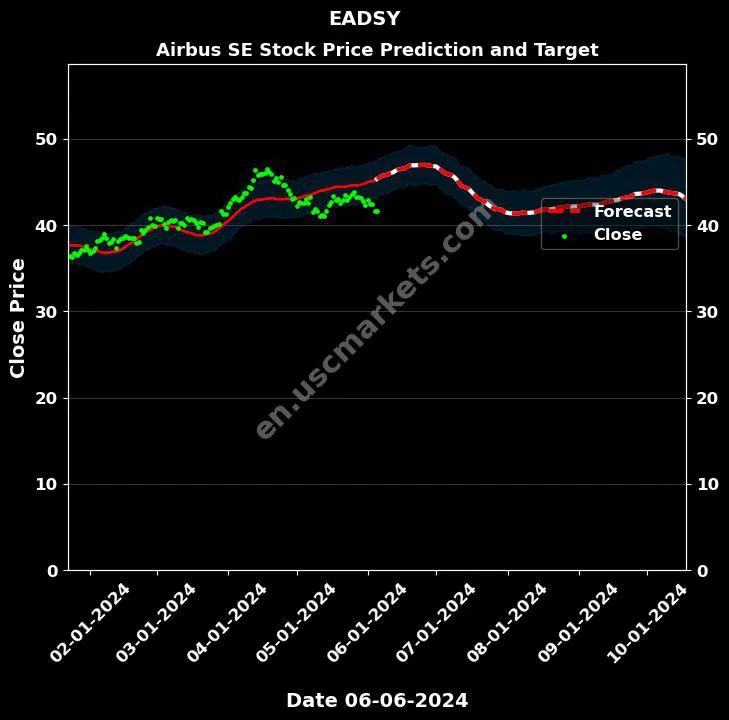

EADSY with AI Stock Forecast & Price Target

On the EADSY chart Airbus SE price was recorded as 41.7 Dollars on 06/05/2024.

The artificial intelligence's forecast on EADSY stock is as follows.

The artificial intelligence's prediction error margin for EADSY stock is very high.

There are two types of risk factors in the artificial intelligence's targets: timing and target prices.

For example, the target price for one month later may be realized three months later. But there is no guarantee of this.

The average predicted price for Airbus SE stock over the next 4 months is: 43.6 Dollars.

The commentary on EADSY stock Target Price: Highest: 46.98 Dollars is predicted.

The commentary on EADSY stock Target Price: Lowest: 41.404 Dollars is predicted.

Resistance Price where Airbus SE stock will Rise and Fall:

| Date | Price Prediction |

|---|---|

| 06-25-2024 | 46.980 |

| 10-03-2024 | 43.939 |

| 12-12-2024 | 46.241 |

Support Price where Airbus SE stock will Fall and Rise:

| Date | Price Prediction |

|---|---|

| 08-09-2024 | 41.404 |

| 11-07-2024 | 41.687 |

| 02-25-2025 | 41.617 |

The commentary on EADSY stock: Fluctuations in the target price can be expected in the coming days.

The target price for Airbus SE stock by the end of 2024 is predicted to be 45.299 Dollars.

The price prediction graph prepared with the help of artificial intelligence, the commentary on EADSY stock, and the 2024 target price predictions for Airbus SE are detailed above.

The technical analysis and charts for the commentary on EADSY stock are below.

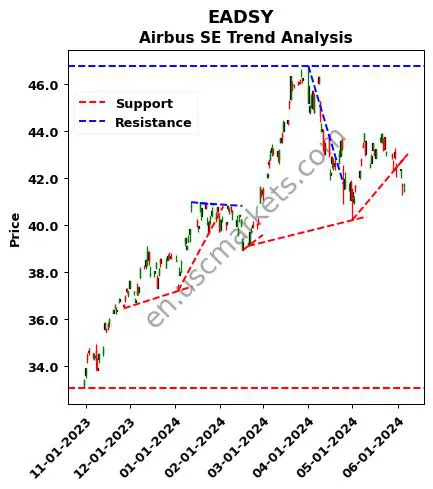

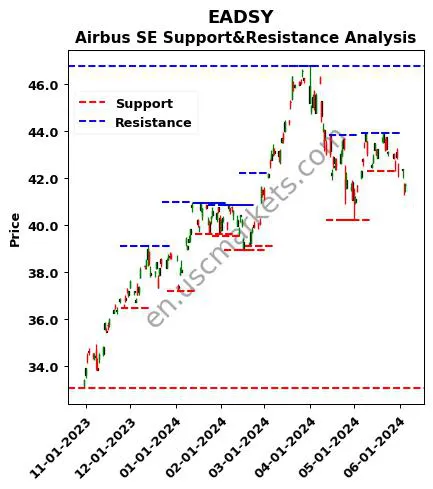

EADSY Support & Resistance and Trend Analysis

EADSY stock you have reviewed the technical analysis support resistance charts regarding.

EADSY : Targeting Support and Resistance Price Levels

According to the algorithmic analysis results related to the EADSY review, the Airbus SE support and resistance prices are as follows.

Support and resistance levels on the chart are not absolute. They may vary depending on market conditions and macroeconomic indicators.

Airbus SE Support and Resistance Prices:

| EADSY Support Level Price | EADSY Resistance Level Price |

|---|---|

| 36.44 | 39.08 |

| 37.18 | 40.85 |

| 38.91 | 40.93 |

| 39.10 | 40.97 |

| 39.54 | 42.21 |

| 39.63 | 43.85 |

| 40.20 | 43.91 |

| 42.28 | 46.78 |

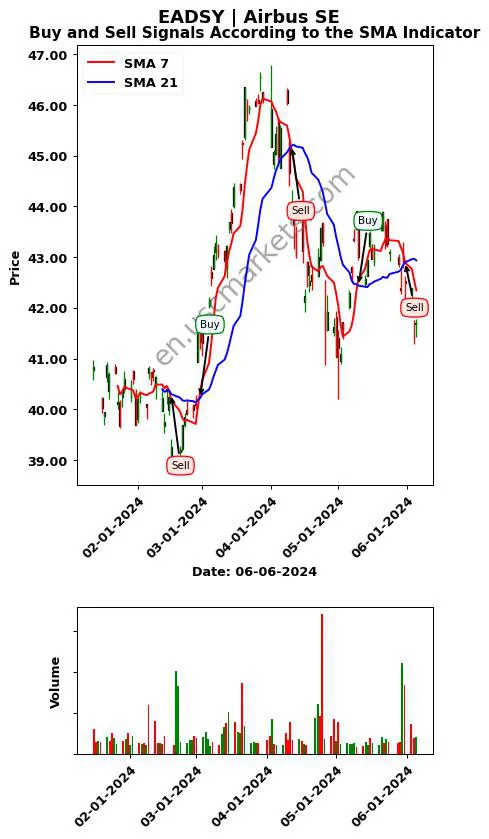

EADSY Technical Analysis: SMA, RSI, MACD

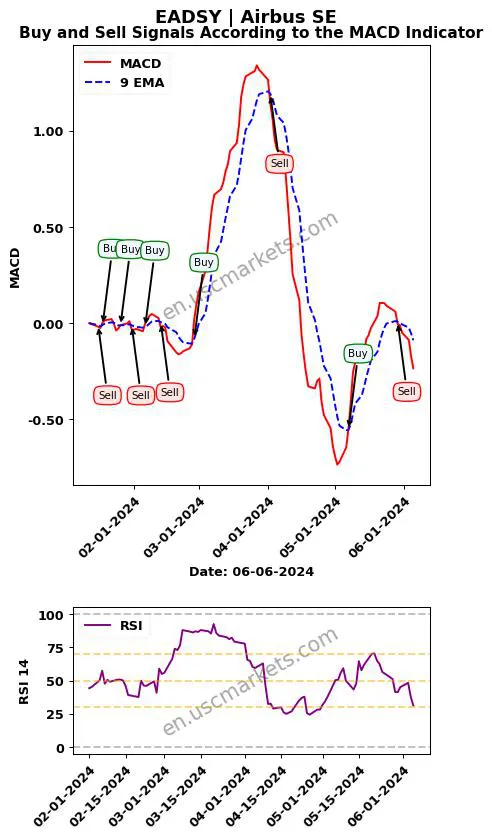

Upon reviewing the EADSY chart, buy and sell signals have been generated in the Airbus SE technical analysis with technical indicators. There are over 100 technical indicators in the market. Each technical indicator can produce different signals.

However, please remember that technical analysis is only a tool and exact results cannot be guaranteed.

On The technical analysis chart and stock comments for EADSY stock are as follows:- The technical analysis for EADSY indicates that the 14-period RSI has most recently generated a 'Sell' signal.

- The technical analysis for Airbus SE indicates that the MACD indicator (with parameters 9, 12, 26) has most recently generated a 'Sell' signal.

Basic Technical Analysis Tips for Financial Markets

- Moving averages may not yield reliable results in stagnant, sideways markets.

- According to MACD technical analysis, the most optimal buying opportunity is a 'Buy' signal given when the MACD is below the 0 level.

- An RSI crossing below 70 is used as a sell signal, and a crossing above 30 is used as a buy signal.

- During a strong upward trend, the RSI can rise above 70 and stay there.

- No indicator is perfect. Having indicators corroborate each other can increase the chances of success.

- Instead of fully relying on these indicators for your investment decisions, it is recommended to conduct a comprehensive analysis and consult a professional financial advisor.

You have read the comments, technical analyses, target prices, and financial reports for Airbus SE stock: Click here to read more predictions on Anheuser-Busch InBev SA/NV stock.

Click here for price target predictions and technical analysis charts of other American stocks