DD Stock Forecast & DuPont de Nemours Chart Analysis

This article provides a detailed analysis of DD-DuPont de Nemours stock including a forecast for DD shares. It features DuPont de Nemours, Inc. technical analysis, support and resistance levels, financial report evaluations, buy and sell signals based on simple moving averages and MACD, and artificial intelligence-assisted target price predictions

Stocks can be purchased through banks, brokerage firms, investment funds, and individual retirement systems.

DD Historical Data Review

DD Current Price Performance Analysis

The DuPont de Nemours - DD stock traded on the American stock market, on 06-05-2024, closed at 80.62$ with a %0.35 increased compared to the previous day.

In the last month, the price of DD changed by %2.66 increased in value, from 78.53 dollars on 05-06-2024 to 80.62 dollars, increased.

Last year, the price of DD was 71.04 dollars on 06-06-2023, and changed by %13.49 increased in value, to 80.62 dollars increased within a year.

The price of DuPont de Nemours stock is riding high above the 50-day and 100-day moving averages. This means it's on a positive run for now, great news for those who got in early. But let's not take our eyes off the ball; no stock climbs forever.

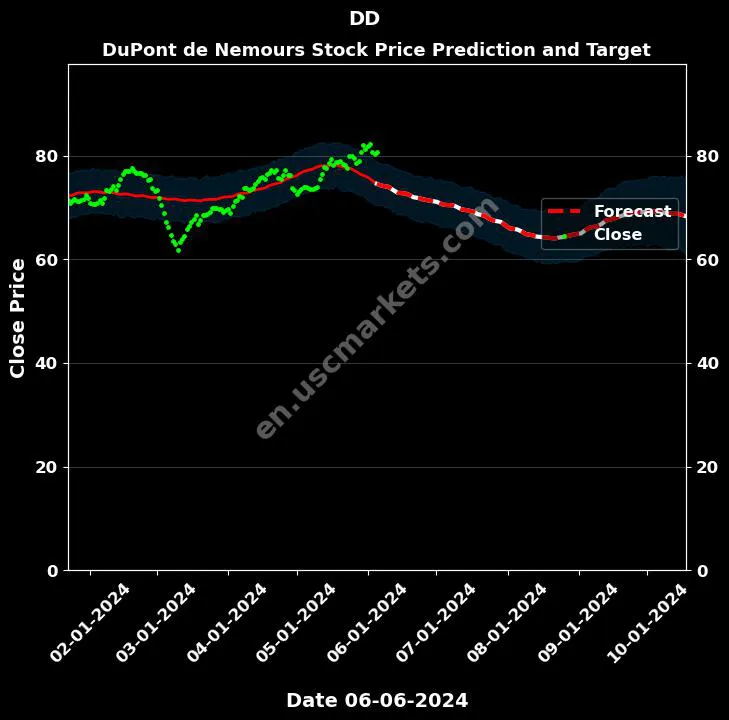

DD with AI Stock Forecast & Price Target

On the DD chart DuPont de Nemours price was recorded as 80.62 Dollars on 06/05/2024.

The artificial intelligence's forecast on DD stock is as follows.

The artificial intelligence's prediction error margin for DD stock is very high.

There are two types of risk factors in the artificial intelligence's targets: timing and target prices.

For example, the target price for one month later may be realized three months later. But there is no guarantee of this.

The average predicted price for DuPont de Nemours stock over the next 4 months is: 69.4 Dollars.

The commentary on DD stock Target Price: Highest: 73.962 Dollars is predicted.

The commentary on DD stock Target Price: Lowest: 64.153 Dollars is predicted.

Resistance Price where DuPont de Nemours stock will Rise and Fall:

| Date | Price Prediction |

|---|---|

| 10-03-2024 | 69.235 |

| 01-01-2025 | 72.504 |

Support Price where DuPont de Nemours stock will Fall and Rise:

| Date | Price Prediction |

|---|---|

| 08-19-2024 | 64.153 |

| 10-28-2024 | 68.092 |

| 03-27-2025 | 68.406 |

The commentary on DD stock: The target price can generally be said to be on the decline.

The commentary on DD stock: Fluctuations in the target price can be expected in the coming days.

The target price for DuPont de Nemours stock by the end of 2024 is predicted to be 72.21 Dollars.

The price prediction graph prepared with the help of artificial intelligence, the commentary on DD stock, and the 2024 target price predictions for DuPont de Nemours are detailed above.

The technical analysis and charts for the commentary on DD stock are below.

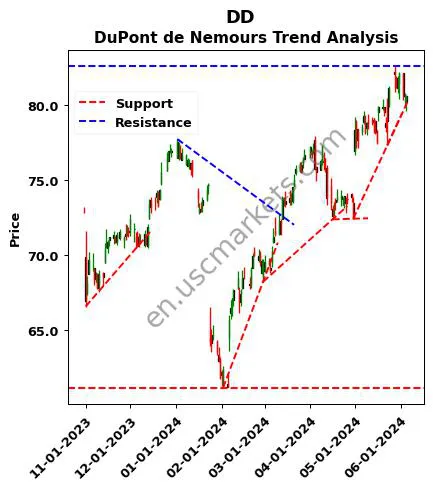

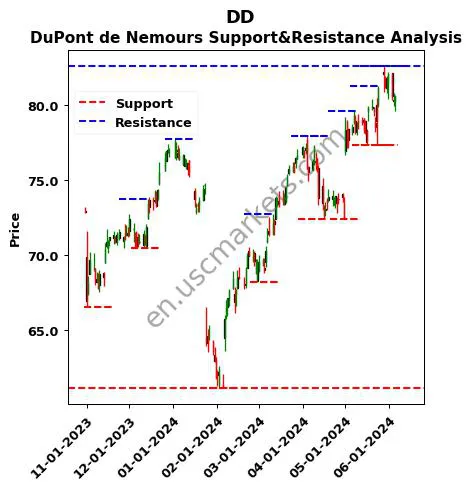

DD Support & Resistance and Trend Analysis

DD stock you have reviewed the technical analysis support resistance charts regarding.

DD : Targeting Support and Resistance Price Levels

According to the algorithmic analysis results related to the DD review, the DuPont de Nemours support and resistance prices are as follows.

Support and resistance levels on the chart are not absolute. They may vary depending on market conditions and macroeconomic indicators.

DuPont de Nemours Support and Resistance Prices:

| DD Support Level Price | DD Resistance Level Price |

|---|---|

| 61.14 | 72.74 |

| 66.56 | 73.75 |

| 68.21 | 77.74 |

| 70.44 | 77.94 |

| 72.38 | 79.63 |

| 72.42 | 81.29 |

| 77.31 | 82.63 |

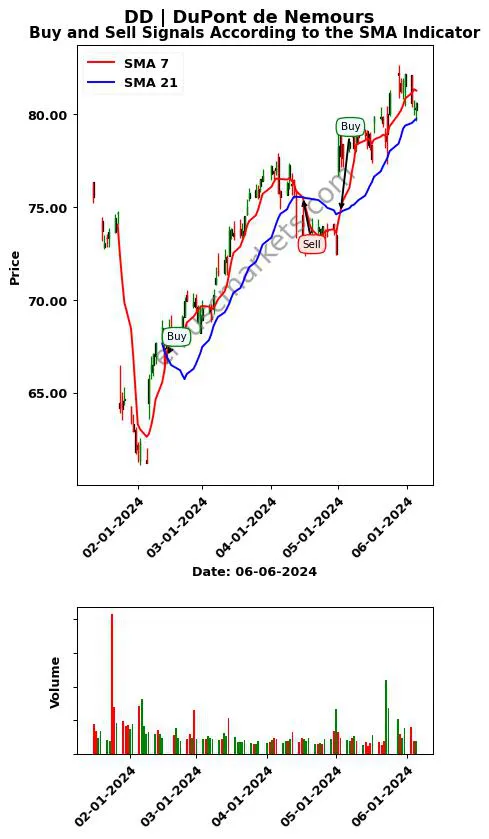

DD Technical Analysis: SMA, RSI, MACD

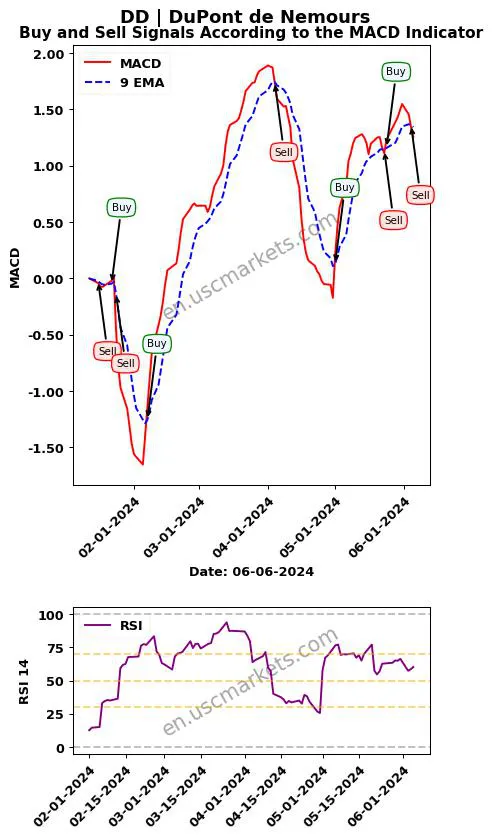

Upon reviewing the DD chart, buy and sell signals have been generated in the DuPont de Nemours technical analysis with technical indicators. There are over 100 technical indicators in the market. Each technical indicator can produce different signals.

However, please remember that technical analysis is only a tool and exact results cannot be guaranteed.

On The technical analysis chart and stock comments for DD stock are as follows:- The technical analysis for DD indicates that the 14-period RSI has most recently generated a 'Sell' signal.

- The technical analysis for DuPont de Nemours indicates that the MACD indicator (with parameters 9, 12, 26) has most recently generated a 'Sell' signal.

Basic Technical Analysis Tips for Financial Markets

- Moving averages may not yield reliable results in stagnant, sideways markets.

- According to MACD technical analysis, the most optimal buying opportunity is a 'Buy' signal given when the MACD is below the 0 level.

- An RSI crossing below 70 is used as a sell signal, and a crossing above 30 is used as a buy signal.

- During a strong upward trend, the RSI can rise above 70 and stay there.

- No indicator is perfect. Having indicators corroborate each other can increase the chances of success.

- Instead of fully relying on these indicators for your investment decisions, it is recommended to conduct a comprehensive analysis and consult a professional financial advisor.

You have read the comments, technical analyses, target prices, and financial reports for DuPont de Nemours stock: Click here to read more predictions on ANTA Sports Products stock.

Click here for price target predictions and technical analysis charts of other American stocks